Trust is good, but the CREDITREFORM business information is perfect!

In Romania, Creditreform is a representative of the prestigious Creditreform International Organization, the European leader in the business information market. Creditreform was founded in 1879 in Germany and has grown over the years to become an International Organization, with over 150 Creditreform offices located in Germany, various countries in Europe, Russia and China, as well as with partners covering virtually all geographical areas of the world.

Are you sure you know your customers and partners? We provide information to help you estimate the risks.

Do not miss any business opportunity and make decisions in the shortest time, as they represent the most important qualities of a successful company in a competitive world, constantly moving, such as is the 21st century.

Do you want to know what the solvency of your clients looks like?

Would you like to have access to financial data and payment behavior? As a member of 123cargo, through the company reports, we offer you a clear picture of your clients and partners!

What is a company report?

For the financial stability of the business and minimizing the risk of non-payment, CREDITREFORM's recommendation for risk-free business is ordering company reports - as a first step before starting transactions between two companies.

The company report represents a complete image on the subject company profile and is the most useful tool in risk management.

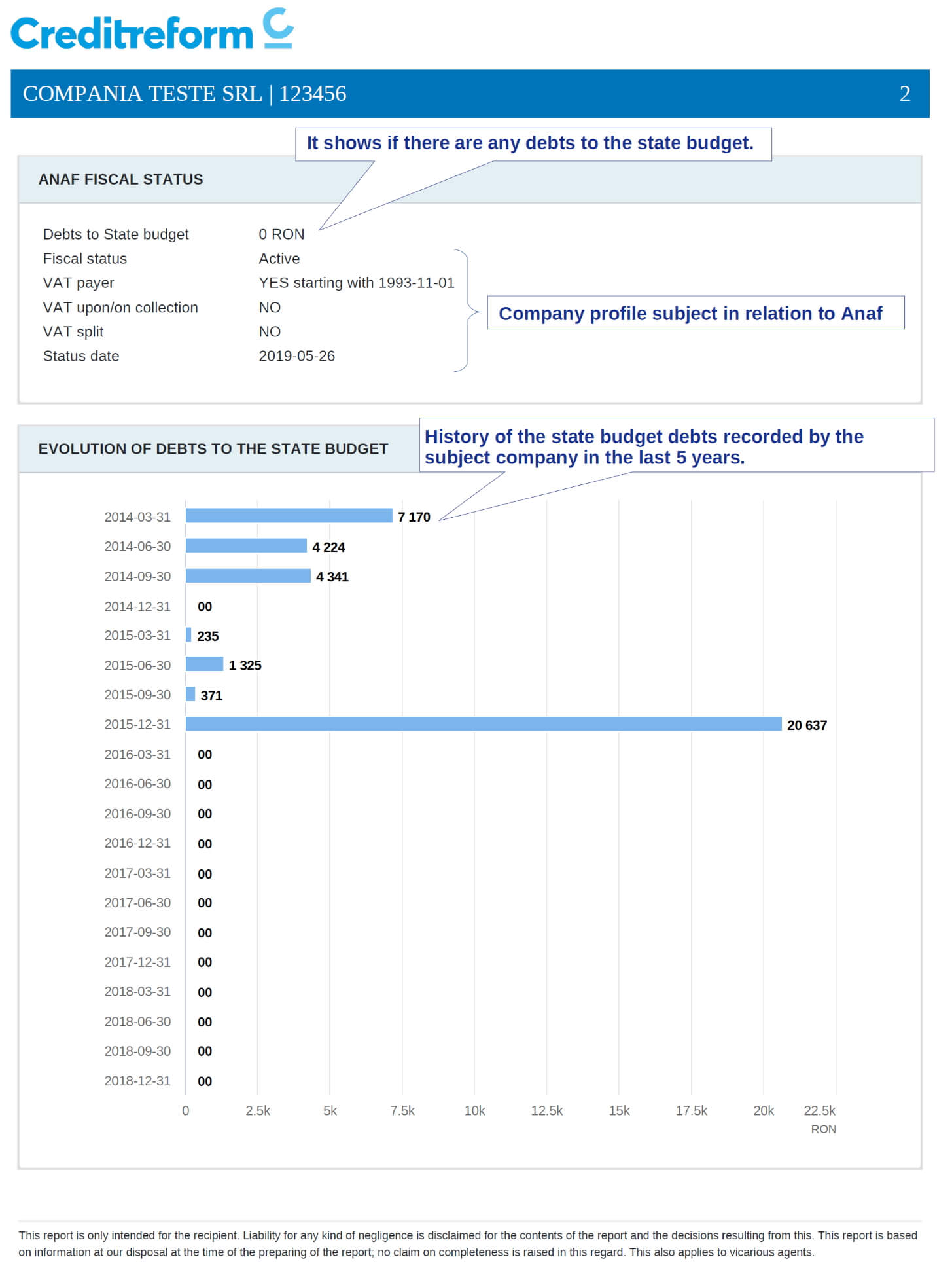

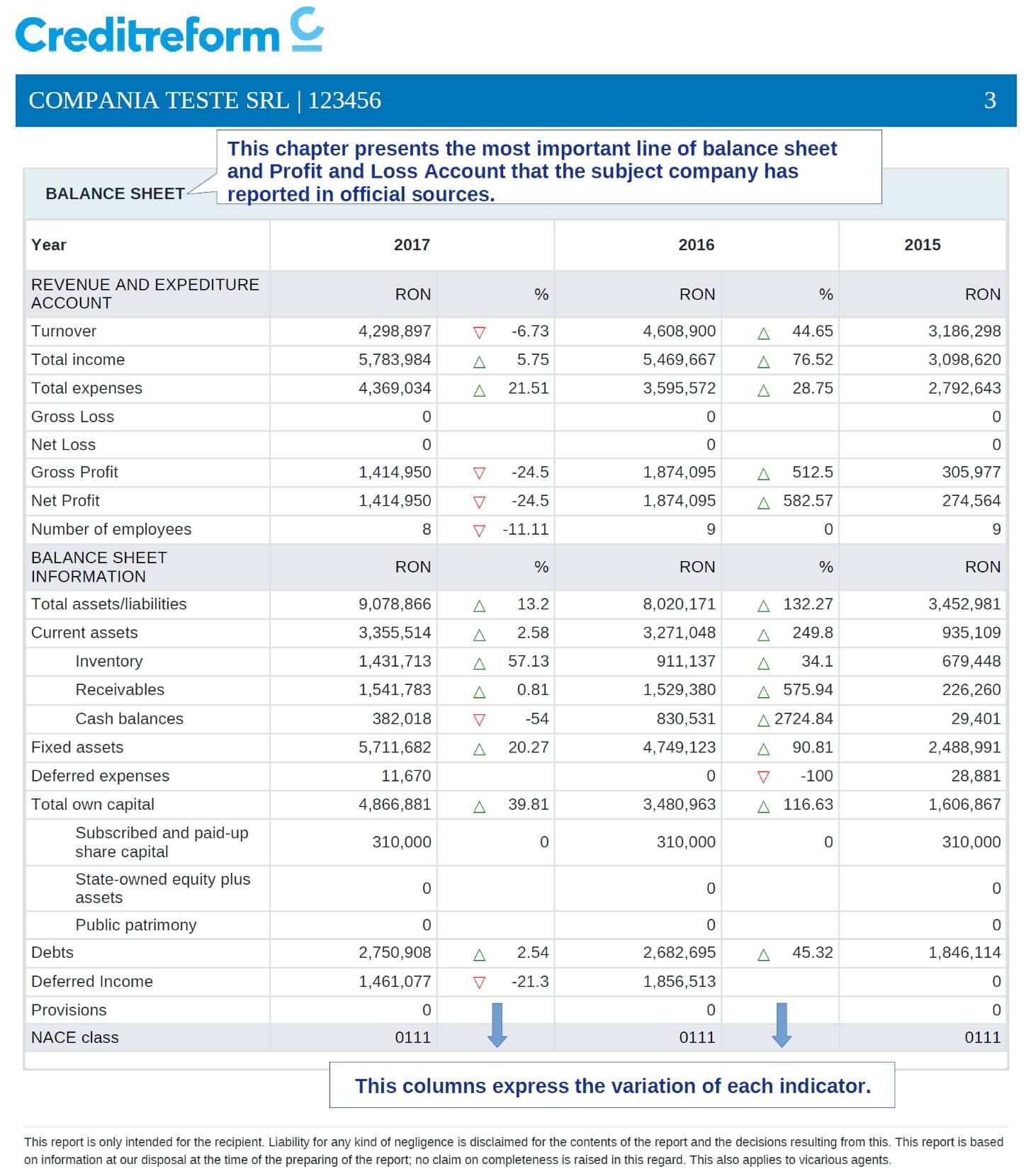

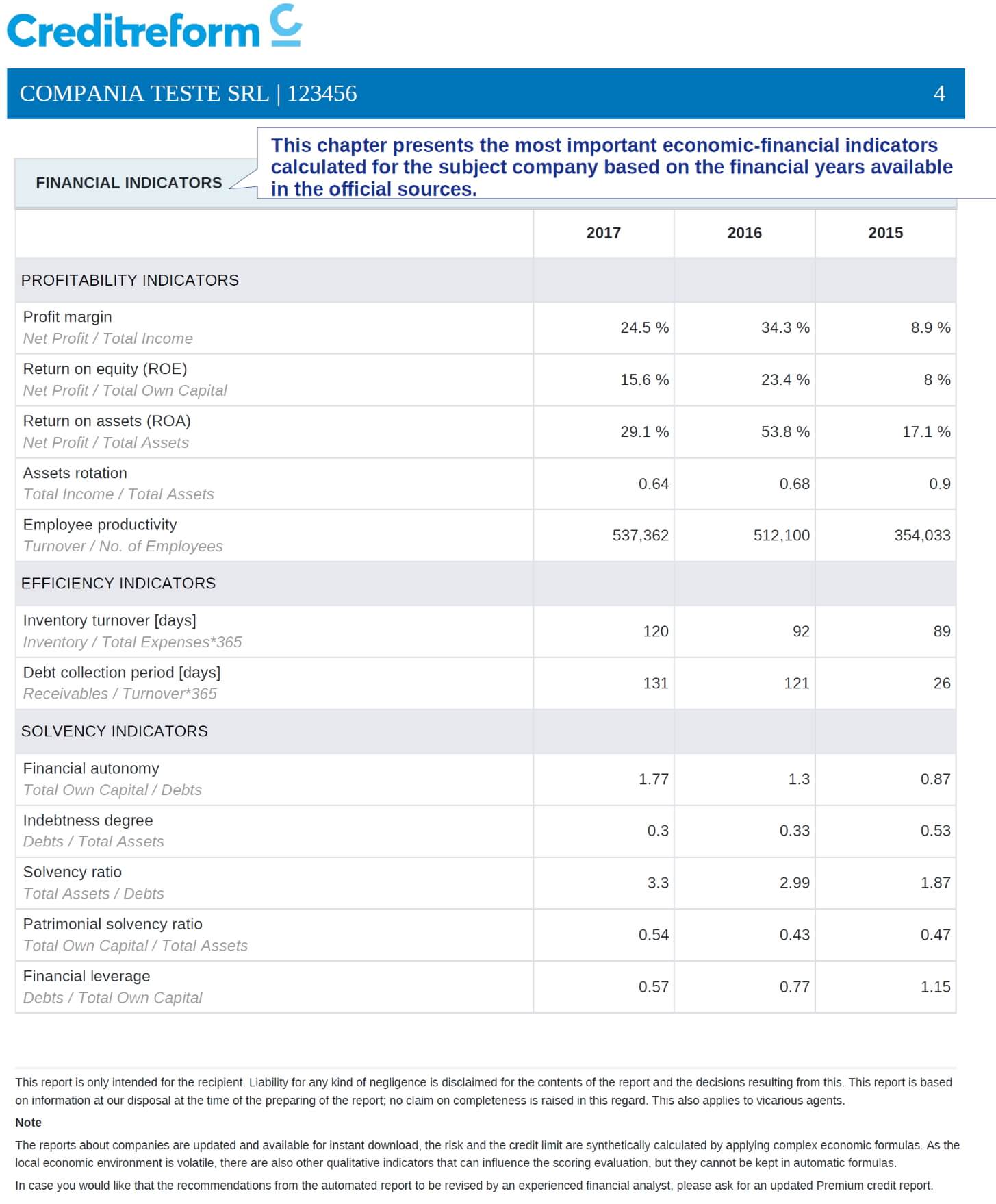

The important information regarding the payment capacity are all analyzed, from liquidity, turnover and capital structure to behavior in payments and structural features such as legal form, the company's debts to the state budget.

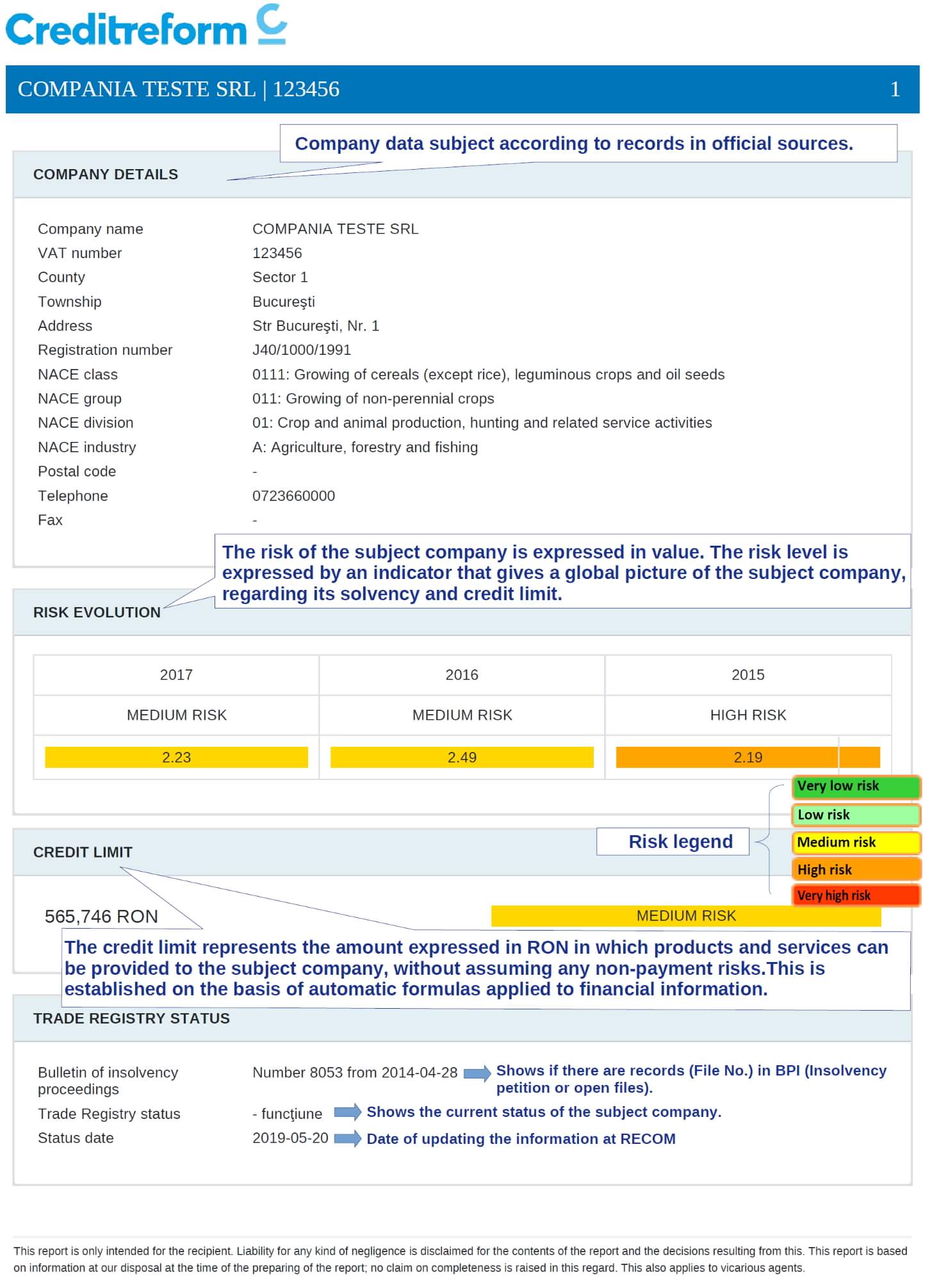

Each aspect is individually appreciated and the results are combined into very important two indicators:

- COMPANY RISK LEVEL

- CREDIT LIMIT

Note:

Company reports are instantly available for download. The risk of the company and the credit limit are calculated synthetically, automatically, by applying complex economic-financial formulas.There are other qualitative indicators that can have an impact on the evaluation, but which can only be analyzed by a financial analyst

When can you request a credit report?

• When contacting a new business partner;

• To verify the existing contractual relations (suppliers, distributors, etc.);

• Periodic knowledge of competitors' performances.

ADVANTAGES OF USING COMPANY REPORTS:

• The correct risk assessment and the exclusive selection of reliable partners for your business;

• Support in the decision-making process of your organization by objectively evaluating the topics;

• Saving the internal resources of the company by outsourcing to CREDITREFORM;

• Company risk and credit limit provided according to specialized risk know-how, through synthetic calculators applied to the financial information reported by the subject company in official sources.

DESCRIPTION OF COMPANY REPORTS

The risk is calculated according to the prestigious Altman Z formula (hereafter abbreviated Z). This formula is based exclusively on the information in the profit and loss account and on the balance sheet of a company.

The risk of the company is expressed in a value, descriptive and visual way, as follows:

Very Low Risk - (VLR) - companies with a higher or equal score to 6 (adică 6 ≤ Z)

Low Risk - (LR) - companies with a higher or equal score to 2.675 and less than 6 (adică 2,675 ≤ Z < 6)

Medium Risk - (MR) - companies with a higher or equal score to 2.22 and less than 2.675 (adică 2,22 ≤ Z < 2,675)

High Risk - (HR) - with a score higher or equal score to 1.81 and less than 2.22 (adică 1,81 ≤ Z < 2,22)

Very high risk - (VHR) - companies with a score below 1.81. (adică Z < 1,81)

Below, you can view a commented model report: